Science Creates Ventures is excited to announce our new Advisory Panel, securing the backing of many talented and experienced individuals, who share our passion for deep tech and will help to deliver investments for world-changing technologies.

Establishing your first venture fund isn’t meant to be easy. Over the past two years, we’ve been on an epic journey of discovery, learning every aspect of what it means to set up, structure and run a fund, and building the skills and knowledge we need to support our portfolio companies in the best way possible.

From building our team and forming a strategy to conducting due diligence and executing investments, it’s been a steep learning curve. It’s also been incredibly rewarding.

On the journey, there have been so many people behind the scenes providing encouragement, support and mentorship to help us grow, especially from the VC community. Thank you!

Today, we’re delighted to announce our new formal Advisory Panel, which brings a wealth of experience from the deep tech and finance domains that will complement our team and enrich our portfolio companies.

As a collective, we have deep technical expertise, with a total of 24 higher education qualifications. We are entrepreneurs who have been on this journey before, having founded and exited 6 companies and supported and led over 30 companies from C-Suite and Chair roles. We have overseen the execution of 19 IPOs and over £7.5Bn in deep tech M&As and other major corporate transactions. Combined with our experience in fund management, with overall responsibility for over £2.8Bn in assets under management, we believe we are well qualified to support our portfolio companies at every stage of their journey.

We look forward to working together tirelessly to establish a top-tier fund and deliver investments that support world-changing technologies that will improve healthcare, quality of life and environment for all.

Without further ado, meet the panel:

Akta is a serial entrepreneur, a qualified solicitor, having qualified at Slaughter and May, and a former investment banker. She founded Enhabit, an award-winning low carbon building company, which was acquired by and absorbed in to Efficient Building Services Ltd in 2020. She is a founding director of Construction Carbon, a company building software to measure embodied carbon emissions. She has created companies serving the real estate sector (Townlab, Flying Butler Apartments, The Apartment Network), procurement (4C Procurement), dentistry (ALS Dental) and edtech (Educate) sectors. These firms are managed by Ansor Ventures, who completed a £50m fundraising in 2020. She is an angel investor and an adviser to multiple venture-backed businesses. She is a chair of the digital board and finance committees at the Royal Free London Foundation Trust, Vice Chair of the Royal Free Charity and a Trustee of BLP, a charity supporting young entrepreneurs in South London.

Charles is a respected chair, director and adviser to public and private companies in the medical technology sector with twenty-five years hard won experience in translating innovation into commercial success and shareholder value. His past and current portfolio includes: as a chair/director, Creo Medical (AIM), IXICO (AIM), MJ Hudson (AIM) and Aircraft Medical (sold to Medtronic); as an investor, Medivance (sold to CR Bard) and Stanmore Implants (sold to Stryker); and as an adviser, The Surgical Group (sale of Distribution Activities to Duomed Group), Medovate, Abcam (AIM), VisionRT (sold to William Demant), and Gyrus Group (sold to Olympus). He has reviewed over a thousand medtech innovations as chair of the NIHR’s i4i grant giving panel.

David is one of the foremost Pharma/biotech deal makers operating in Europe. Originally qualified as a pharmacist he joined Shire in 1999 when its market cap was approx $200M, when he left his role of head of business development in 2014 it had grown to $30Bn. David led many of the deals instrumental in driving the company growth. Since leaving Shire David has split his time between a number of Board roles (Orexo, HRA Pharma, Nasdaq listed SPAC, Forendo, Oak Hill Bio) and representing biotech companies in negotiations with Pharma. His total value of deals delivered (if all milestones are reached) is over $5Bn.

David is co-founder and director of Revena, a technical consultancy and network that supports both deep tech investors and companies. He has led the technical evaluations of over 150 companies on behalf of funds with over $6bn under management. An active translational scientist, he has worked with a range of large and small companies (incl. Dow Chemical and OxSyBio) guiding research towards novel intellectual property and through product development. A former academic (Universities of Oxford, Bristol, and California), he has over 30 papers and patents and is a technical advisor to multiple science-focused companies (incl. BioFeyn, Milosensors, and Vatic Health).

Emma has been a member of Science Creates Ventures’ Advisory Panel since 2020. She is CEO of Weatherden, a leading early clinical development company, and CEO of Remedy Rx, a digital health company supporting patients with chronic disease with the aim of ultimately transforming care, research and medicines under development. She has extensive experience in R&D strategy and clinical development across multiple therapeutic areas. She has been involved in the creation of 5 biotech companies in addition to Weatherden and Remedy Rx (Artios Pharma, Sitryx Therapeutics, Enara Bio, Trex Bio, Zarodex Therapeutics). Emma qualified as an accountant at KPMG with life sciences, private equity and transactions experience before moving to SV Health Investors, a blue-chip transatlantic healthcare investor where she worked between 2015 - 2018. She initially worked on the public fund, International Biotechnology Trust (£250m - 2017) at SV Health Investors before moving to the Venture Capital team, focussed on biotech company creation for a $400m fund.

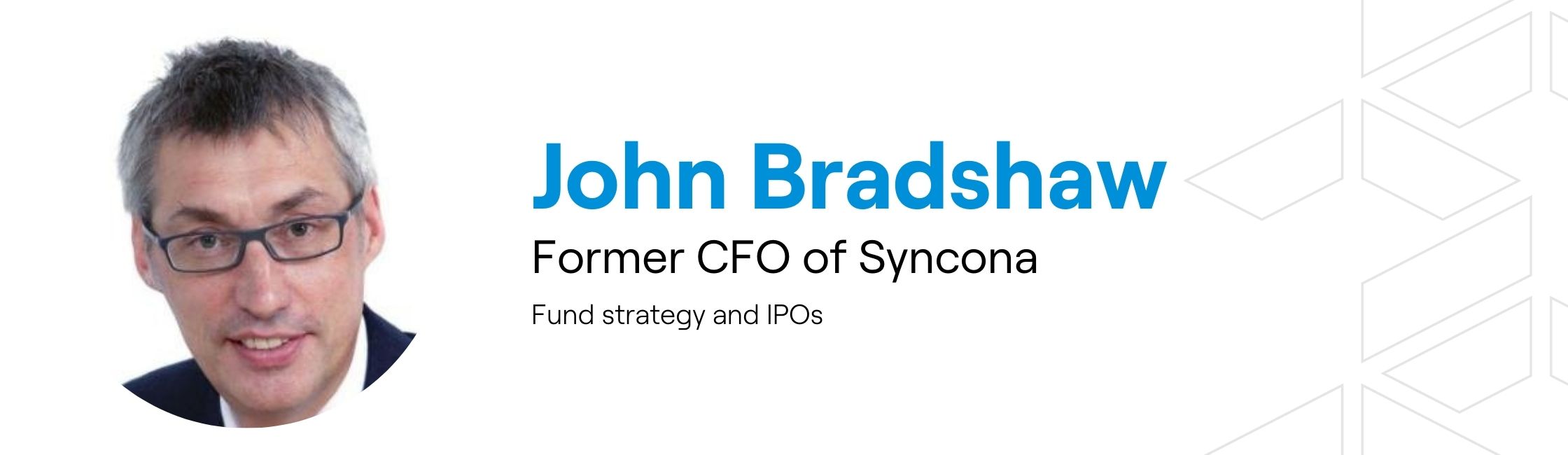

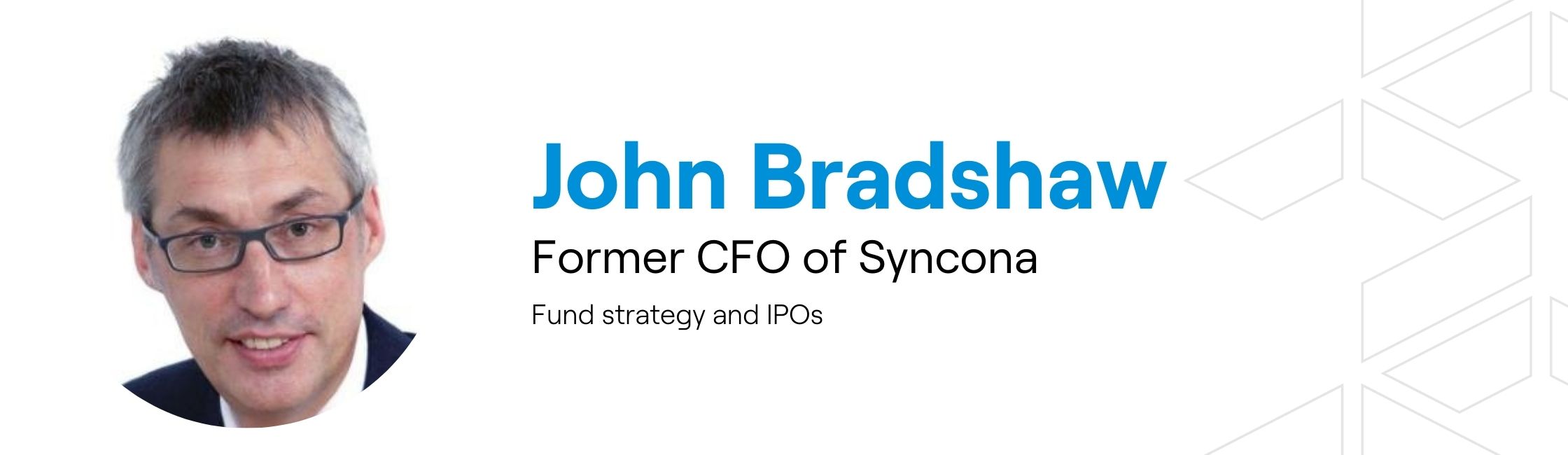

John is a chartered accountant with more than 25 years’ experience as a Chief Financial Officer with venture capital backed and listed companies focussing particularly on medical device and biotech companies from start up through commercialisation. From its foundation in 2012 to his retirement in July 2021, John was the Chief Financial Officer of Syncona Investment Management Limited, the Investment Manager of Syncona Limited, a FTSE250 listed life sciences investment company which grew assets under management from £100m to £1.3bn in that period. John is a Non-Executive Director and audit committee chair of AIM listed medical device company Creo Medical Group plc.

Jon co-founded Science Creates Ventures in 2020 and has since played a leading role on its Advisory Panel. Jon also sits on the Board of Science Creates Ventures LLP. Jon is a seasoned tech entrepreneur with a background in software engineering and multiple exits under his belt. Jon exited his first company, Cramer, for $425m in 2006, representing an exit value to capital raised ratio of 47x. Since then, he has been an active and successful angel investor. Some notable examples include the exits of Swiftkey (undisclosed - 2016) and Zynstra ($130m - 2019). Jon was also a significant angel investor in Creo Medical, which listed on the London Stock Exchange’s growth market in 2017 (LON: CREO). A significant aspect of Jon’s success has been how he has focussed his energy on just a few companies, often playing active roles either at board level or as a mentor.

Jonathan is Chief Operating Officer of Circassia PLC, a medical diagnostics company, a position he had held since 2019. He has more than thirty years’ experience of business leadership in the life sciences sector. Prior to joining Circassia in 2019 he worked for Pfizer (1999 to 2019) in a variety of senior leadership roles including Managing Director Pfizer UK and finally Chief Commercial Officer Pfizer Internal Medicines. At Pfizer he led the launch of 15 products across a broad range of therapeutic areas and worked on numerous product and company transaction and executed several business turn arounds. He was elected President of the Association of the British Pharmaceutical Industry (2013-15). His interests include angel investing and supporting science-based innovation. Jonathan has a BSc in Materials Science.

Keith has over 30 years of corporate finance experience both with major financial institutions (Citibank & Lloyds Bank) and within boutique investment firms (Manresa Partners and Aspanova). As an investor, director and mentor of multiple early-stage companies, his career has included the sale of Ziylo Limited to Novo Nordisk A/S in 2018, the sale of Activate Clients to FD Technologies plc in 2015, membership of the Lloyds Development Capital Investment Committee 2009-2013, Executive Chairmanship of both Science Creates Incubators and Carbometrics Ltd plus numerous other relevant roles and experience. Keith is a Chartered Director and a Fellow of the Institute of Chartered Accountants.

Mark has a portfolio of chairman roles in early-stage technology companies. With a background in engineering and physics, his career began at optics start-up Kymata, which was acquired by Alcatel Optronics for €120m. He then held a variety of executive roles in VC and PE backed companies. At instrumentation company Insensys, he sold the oil and gas division to Schlumberger (undisclosed - 2007) and the rest of the business to Moog ($23m – 2009). Mark has also spent 5 years as a venture capital investor. He led hardware investments at Mercia Asset Management, which grew during his time from around £90m to £900m assets under management.